Freshworks: How the Dennis Woodside-Girish Mathrubootham combination might deliver on its promise

Three months ago, investors didn't immediately like the transition, but is this the better strategy for the company's future?

Dennis Woodside, CEO Freshworks.

Image: Balaji Gangadharan for Forbes India

Dennis Woodside, CEO Freshworks.

Image: Balaji Gangadharan for Forbes IndiaSitting in a glass cabinet in a room at Freshworks’s Chennai headquarters, is a Sengol (in Tamil), a gold-plated sceptre that in the days of yore, kings and chieftains would pass on to their successors as a mark of transfer of power, especially in South India. This particular one, Girish Mathrubootham handed Dennis Woodside a few months ago, in a symbolic gesture, as he handed over the chief executive’s role at the software company he’d founded 14 years ago in one room and grown to a multi-billion-dollar US listed enterprise.

Woodside is now tasked with taking the business to its first big milestone as a listed company—a billion dollars in annual revenue by 2026—and then building on that foundation. Mathrubootham, taking the title of executive chairman, has stepped away from the daily scrummage that a public company’s CEO is subjected to. He’s focusing on the company’s products-and-platform strategy, especially as artificial intelligence is becoming mainstream.

“We have, just in the last year and a half, moved from not generating a lot of cash to clearly cash flow-positive and on our way to profitability,” Woodside told Forbes India, in an interview on June 17 during a visit to the company’s Bengaluru office. That was one of the important factors that went into the decision on the timing of the transition.

That Woodside would eventually head the company wasn’t explicitly part of the conversations when he joined Freshworks as its president two years ago, he says, but Mathrubootham was certainly looking for someone able to help him run the entire business with an eye to the future. And Freshworks’ management was indeed reporting to both of them pretty much from the get go.

Later on July 30 (2 pm PT in the US, and 2.30 am of July 31 IST), Freshworks will report its fiscal Q2 earnings results, the first quarterly numbers under Woodside as CEO. The company follows a January-December fiscal calendar.

Beyond that, he has his job cut out for him. Projected to hit about $700 million in revenues this year, Freshworks is behind only Zoho when it comes to independent software products companies with an India heritage. But, in the US, the company is only one of hundreds of mid-sized software vendors, taking on much bigger, multi-billion-dollar rivals.

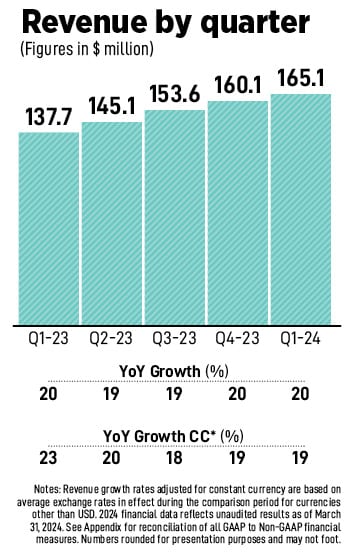

Even as Freshworks’s revenues have gone from $498 million for FY22 to a projected $695-705 million for FY24, growth has halved from 34 percent to the 17-18 percent estimated for the current fiscal year. Reasons include a combination of macroeconomic factors and a broad reversal in tech spending in the US from the initial post-Covid surge.

In this period, Freshworks has also stepped up its efforts to transition from serving mostly small and medium business (SMB) customers—who are typically more vulnerable to macro changes—to larger, enterprise customers, who have bigger software needs and deeper pockets. Perhaps the numbers also reflect the very much work-in-progress nature of this change that Freshworks is undergoing.

Investors seemed to not immediately like the idea of Mathrubootham relinquishing the CEO’s role: On May 2, the day after the company announced the news, Freshworks shares fell as much as 28.7 percent, to $13.01, from the previous day’s closing price of $18.25 before ending at $14.67, a 19.6 percent drop. Since then, the stock’s fallen a bit more. Freshworks ended July 29 at $13.31 on the Nasdaq. Overall, the stock is down by about 71.5 percent, as of July 29, since its IPO on the Nasdaq in September 2021

At this point, however, Wall Street analysts seem to like its prospects. On the Nasdaq, the consensus view of 16 analysts is that Freshworks is a “strong buy”. The average 12-months target price for the stock is $17.92, based on analysts who provided such projections within the last three months, according to Nasdaq.

Also listen: Freshworks CEO Dennis Woodside on the chess game to a billion dollars and beyond

Ready for scale

With about 67,500 customers worldwide—the US and western Europe being its biggest markets today—Freshworks is in an “amazing position”, Woodside said. “The products that we sell are necessary for every business in the world to serve its customers and its employees.” The point was he making is that these aren’t just good-to-have software but essential ones.Freshworks’s products and solutions include those that have evolved from and around the helpdesk software that Mathrubootham started the company with, a customer engagement stack, an IT services management product, which is Freshworks’s fastest growing business, and software for sales and marketing management. A good deep-dive description is offered by Capterra, a company that provides independent insights to businesses looking to buy software.

Freshworks is helping customers automate a growing share of these various tasks and processes, making their overall business operations more efficient. In India, Dunzo for example, uses Freshworks’s customer engagement software to serve millions of end-consumers, Woodside said. PhonePe, the Indian fintech company that’s part of Walmart, is another digital-native customer of Freshworks in India.

Freshworks is helping customers automate a growing share of these various tasks and processes, making their overall business operations more efficient. In India, Dunzo for example, uses Freshworks’s customer engagement software to serve millions of end-consumers, Woodside said. PhonePe, the Indian fintech company that’s part of Walmart, is another digital-native customer of Freshworks in India.In its biggest markets, customers Freshworks added this year include Coeur Mining, Kramp, British Transport Police and Young Capital. An example of customers from other promising markets include Dark Matter Technologies, a cybersecurity company based in Abu Dhabi, UAE, that Freshworks signed on in Q1 this year. Freshworks also opened a new data centre in the UAE on June 27, for quicker response to customers in that region and in African regions, in addition to meeting data sovereignty and privacy rules in those markets.

Apart from born-to-the-internet companies or the tech-heavy businesses, “many companies are still early in their journey to digitalising their operations… and we can play a big role there,” Woodside said. And “AI is the next set of capabilities that we're putting on the platform that we've already built. So, we're in a great position. But going forward, it's really all about scaling up from here.”

Woodside is doing this by both consciously going after larger accounts, and in multiple geographies. The company offers some insight into the larger accounts aspect of its operations each quarter by breaking out some data on how many customers are paying it $50,000 or more each in annual subscriptions.

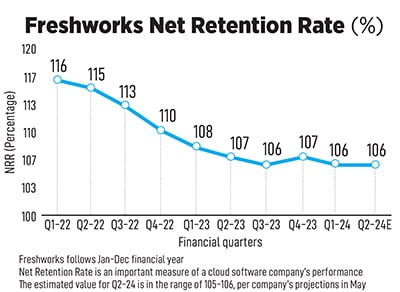

By the end of Q1, there were about 2,600 such customers and they accounted for almost half (49 percent) of Freshworks’s annual recurring revenues. This cohort grew 29 percent in Q1 from a year ago, while the expansion of overall customer base has fallen from 12 percent to 4 percent in about the same period. Another, larger, cohort that comprises customers paying $5,000 or more (numbering more than 20,500) has also grown more slowly, at 12 percent in Q1 versus 19 percent a year earlier, reflecting the impact of the macro uncertainty that persists.

The focus on larger accounts is in every geography. In India, Mahindra Group is an example of a customer using the Freshservice IT service management software. “Any internal question an employee may have at Mahindra about their IT, software problems, password problems, that's all managed through Freshservice,” Woodside said.

Tata group’s consumer products business is another example of an Indian conglomerate using Freshworks. In this case, the business “uses us to manage all of their relationships with their distributors,” Woodside said. In the coming months and quarters, “you'll see more deployment and usage of AI across our products.”

More AI

Current examples of Freshworks’s AI at work include its Freddy Self-service, which customers such as Dunzo use to “deflect” inbound customer queries to an AI agent, and Freddy Copilot, which makes human agents more effective. Copilot became generally available to customers in Q1.Mathrubootham said he actually measures these “deflection rates”: Companies, including Porsche eBike, Lightricks and Travelopia can leverage self service capabilities to improve personalisation and provide AI-generated answers from their knowledge base, he’d told analysts in May. At that time, Freshworks’s customers had seen deflection rates of more than 40 percent resulting from these bots, he’d said.

Freshworks has had machine learning and natural language processing features in its products from 2018, Woodside said. Today there are 70 distinct AI features across its products, he added. For example, one feature is AI-based automated summarisation of customer-agent interactions, which allows managers to make sense of what happened and take decisions. Similarly, Freshworks offers AI that can help collaborative problem-solving in IT operations management, and an AI solution that acts as a helpdesk of sorts for business teams, outside the ambit of IT, called Freshworks for Business Teams.

Freshworks has had machine learning and natural language processing features in its products from 2018, Woodside said. Today there are 70 distinct AI features across its products, he added. For example, one feature is AI-based automated summarisation of customer-agent interactions, which allows managers to make sense of what happened and take decisions. Similarly, Freshworks offers AI that can help collaborative problem-solving in IT operations management, and an AI solution that acts as a helpdesk of sorts for business teams, outside the ambit of IT, called Freshworks for Business Teams.Much of all of this has been built between the last 2 years and 12 months by the company’s technical employees, who now number about 2,000 and are spread over Chennai, Hyderabad and Bengaluru. The features tap well-known large language models (LLMs) including those from Azure OpenAI, Anthropic and various opensource LLMs. Overall, Freshworks has about 4,900 employees.

Acquisitions are very much on the table as a strategy to expand Freshworks’s product portfolio. US-based Device42 is the first business Freshworks has acquired as a public company; it has the niche expertise of keeping track of an enterprise customer’s on-premises IT assets. Its software scans and catalogues computers, servers, storage devices, network devices, what have you, on-premises, behind a firewall. This complements what Freshworks has in its cloud-based features, such as IT operations management and IT asset management, within its Freshservice IT service management product.

This is an example of going deeper within a product, Woodside said. Expanding its AI to support IT operations management is an example of going broader; he expects Freshworks will do a lot of both.

Sweet spot

For CMO Mika Yamamoto, the challenge is to tell enterprise customers a credible story about how Freshworks’s products are equally user-friendly and relevant—as they have been to the SMB segment—while offering the enterprise-grade features for handling complexity, scale and security. “As we transition to a bigger company, a lot of the questions are about who we are focusing on, and trying to be all things to all people makes you master of none,” she pointed out in an interview to Forbes India on June 28. “Therefore, we are honing our focus.”Yamamoto wants to drive home the message, to industry analysts, for example, that Freshworks is doubling down on AI-based solutions that address “the upper end of the SMB market to the more complex needs of the mid-market and lower end of enterprise solutions.” That would typically mean customers with a few hundred employees to businesses with several thousands of them.

With Freshservice, the IT service management business, the focus is clearly on the mid-market customers. “That’s our sweet spot,” Yamamoto said. Much of the SMB business still comes from the customer service software.

A complementary effort on the sales front is being led by Abe Smith, whose appointment as chief of global field operations, Freshworks announced in February. Most recently, Smith was head of international at Zoom, where he expanded the field sales organisation outside the US as the company grew from roughly $300 million to over $4 billion in sales.

In addition to Yamamoto’s marketing and branding efforts, “mission number one is also with our field organisation and our partner network, to get in front of more customers and create additional awareness professionally,” Smith told Forbes India on June 27.

“We're building a next-generation sales organisation that is highly professional and that will also use next-generation tools,” he says. These teams are using AI internally to sell better. “So, when we engage with a customer, we want to be more intimate, more knowledgeable, more aware, and also faster in how we respond to customer requests.”

In short, the expectation is “we will become an AI-enabled field organisation.”

SaaS 2.0

The context is what some in the industry call SaaS 2.0, Smith said, where enterprise customers today expect their software to have the same ease of use and elegance that the consumer software products have come to be known for. The big picture is that “software as a service has become the standard way to buy enterprise software now,” said Liz Herbert, a vice president and principal analyst at Forrester Research, widely seen in the tech industry as one of the two top enterprise IT advisories, the other being Gartner.This is true not only for CRM (customer resource management) that Salesforce pioneered as a cloud model, but “even ERP and supply chain, which are now shifting to software as a service,” Herbert told Forbes India in an interview on July 11. ERP (enterprise resource planning) software packages are complex, and in the past took several months to install and customise before businesses could actually use them.

Today “software as a service tends to go hand in hand with the idea of frequent automatic upgrades. And everybody's focussed on AI, how can I get more AI through these automatic upgrades and innovation that is coming my way. And then it's also going hand in hand with low code,” she added.

Also read: Freshworks' top lineup takes shape amid hope that NRR will bottom out

Contender

On its well-known ‘Forrester Wave’ comparison of vendors, Forrester rates Freshworks as a ‘Contender’ in the category of enterprise service management, in a November 2023 report, after evaluating the July 2023 version of Freshworks for Business Teams product. Freshworks’s innovation strategy “primarily focuses on self-service and AI insights,” the analysts wrote in the report. “However, some areas, like the roadmap development and partner ecosystem, could benefit from further expansion.” They added the caveat that the product briefing for this evaluation did not comprehensively discuss the roadmap’s development.According to the report, Freshworks boasts a diverse partner ecosystem, but it’s not as extensive as at some of its competitors’, while customers praise the ease of adoption, low complexity, automation capabilities, and workflow design simplification. “Freshworks is a good fit for small and midsize organisations that want to build or mature an ESM practice,” the analysts concluded.

ServiceNow, a much larger rival that Freshworks has taken direct aim at, is rated as a ‘Leader’ on the same Forrester Wave for the ‘Vancouver release’ of its eponymous software. The ratings on the wave start with ‘Challengers’, followed by ‘Contenders’ and ‘Strong Performers’, and ‘Leaders’ at the top. This year, in a March 6 report, in the category of customer service solutions, Forrester analysts placed Freshworks at the transition between ‘Contenders’ and ‘Strong Performers’ on their Forrester Wave infographic, well ahead of Zoho. ServiceNow, again, was among ‘Leaders’.

Playing to strengths

In this context, perhaps it makes sense for Mathrubootham to focus a lot more of his efforts on building AI that enterprise customers find useful and reliable, while being plugged into the business side of things via the close partnership he seems to have built with Woodside.In fact, in May, in response to a Wall Street analyst’s query on the transition, he described the move as “playing to our strengths”. He wears his passion for product engineering on his sleeve, while Woodside is an operator—industry jargon for senior executives running businesses—with the provenance of having seen and helped lead multi-billion-dollar operations. Over a decadal career at Google, he rose to become president of Americas and oversaw Motorola Mobility, a $12.5 billion acquisition. Later, he helped take Dropbox from $200 million to a billion dollars in revenue in four years. He’s also an Ironman triathlete.

The flipside of high-growth SaaS is “some companies have too much SaaS because it's been so easy for business users to go out and buy,” said Forrester’s Herbert. “So, we see a lot of our clients running into the same old problems of having shelf wear, things they pay for that they don't use, as well as technical debt in the form of redundant overlapping software. We are seeing a bit of a wave of rationalisation going on, where companies in this uncertain economy are looking to optimise their technology spend.”

Here again, perhaps the Woodside-Mathrubootham combination is the right one, where the latter focuses on products that stand out in a hyper-competitive environment and the former can convince larger customers to embrace those products.

A simple example that highlights the extent of competition in the environment is the fact that startups continue to spring up, convinced they can do CRM better, an area where there are already nearly 1,400 vendors in the US alone, according to one estimate. Just in the last week of July, Zepic, a pre-seed-funded startup, announced it had launched a hyper-personalised customer engagement software product, backed by angel investors including from Freshworks and Apple.

Woodside summed it up: “We're large enough to deliver amazing products and have amazing customers, but we're small enough to be nimble. It’s an exciting time to be at Freshworks.”